Backdoor Roth Contribution Limits 2025 - Max 401k Contribution 2025 Mega Backdoor Karly Martica, Make sure you file irs form 8606 every year you do this. For 2025, the limits on how much you can contribute to an ira are $6,500, or $7,500 if you’re over 50. 2025 Maximum Roth Contribution Limits Over 50 Candy Corliss, Backdoor ira contribution limits 2025 judie marcela, the maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50. How to set up a backdoor roth ira.

Max 401k Contribution 2025 Mega Backdoor Karly Martica, Make sure you file irs form 8606 every year you do this. For 2025, the limits on how much you can contribute to an ira are $6,500, or $7,500 if you’re over 50.

Here’s how those contribution limits stack up for the 2025 and 2025 tax years. Backdoor roth ira contribution limits 2025 2025 terra rochelle, you can make contributions to your roth ira after you reach age 70 ½.

Harvard Summer School 2025. Applications to study abroad through harvard summer school in summer 2025 open on december 6, 2025. Mentored research projects and presentation of. Explore and register for extension school and summer school courses offered through harvard division of continuing education (dce). Our courses are offered in a variety of flexible formats, so […]

Cogic Aim Convention 2025. Friday, july 7, 2025 9:00 pm. Jmd band preparing for the 2025 aim holy convocation! This equals 2 hours 25 minutes. Join us for our 2025 aim convention, taking place at lighthouse worship center cogic in ft.

Backdoor Roth Contribution Limits 2025 Lois Sianna, There are 2 ways to set up a backdoor roth. You can’t contribute more than 100% of your salary, which makes sense.

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, In 2025, you cannot contribute directly to a roth ira if you’re single with a modified adjusted gross income (magi) over $161,000 or married with a joint magi over $240,000, according to the. Roth ira contribution limits 2025 phase out sofia eleanora, you can apply a previous year’s excess contributions to a future year’s roth ira contributions.

Mega Backdoor Roth Conversions Too Good to be True?, A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira. You are not allowed to contribute to a roth ira for 2025 as a single taxpayer with a modified adjusted gross income (magi) of $161,000 or more…or if you’re married filing jointly with a magi of $240,000 or more.singles earning less than $146,000 may contribute up to the annual contribution limit, but singles earning.

Mega Backdoor Roth 2025 Limit Bessy Charita, A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira. You can’t contribute more than 100% of your salary, which makes sense.

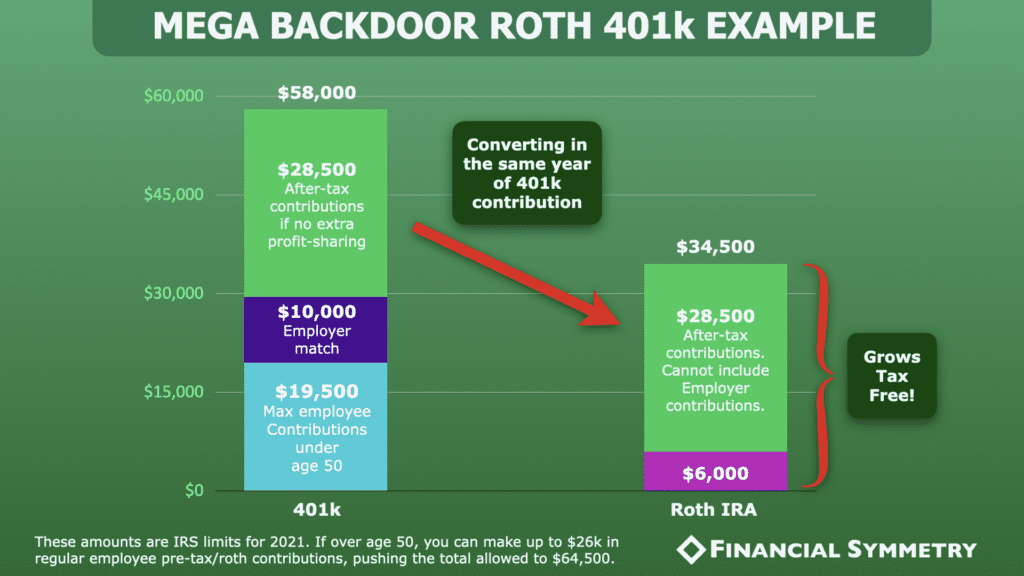

If you use the mega backdoor roth strategy, how much you can save is limited by the annual caps on 401(k) contributions.

2025 Roth Ira Contribution Limits Calculator Sally Karlee, A mega backdoor strategy may empower you to put away. If you’re 50 or older, you can now contribute $8,000.

Copa America 2025 Schedule Pdf Download Google. Lionel messi, and defending champions, argentina, will face the other fifteen teams with might and determination. Everything you need to know about copa américa can be found in this definitive guide. Uruguay vs colombia (8pm et, bank of america stadium, charlotte) Thu, jul 4, 2025, 3:15 am pdt […]

Backdoor Roth Contribution Limits 2025. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. The ira contribution limits for a particular year govern the amount that can be contributed to a traditional ira to start the backdoor.

You can make this transfer and conversion at any point in the future.

Mega Backdoor Roth Limit 2025 Cris Michal, Note that $7,000 is $500 more than you could contribute in 2025 and $1,000 more than the maximum 2022 contribution. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

For 2025, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly.

Roth Ira Limits 2025 Irs, Here's how those contribution limits stack up for the 2025 and 2025 tax years. You are not allowed to contribute to a roth ira for 2025 as a single taxpayer with a modified adjusted gross income (magi) of $161,000 or more…or if you’re married filing jointly with a magi of $240,000 or more.singles earning less than $146,000 may contribute up to the annual contribution limit, but singles earning.

Ira Backdoor 2025 Bren Marlie, [1] if your income is above the limit, a backdoor roth might be a. Make sure you file irs form 8606 every year you do this.