Arkansas Income Tax Schedule 2025 - Arkansas State Tax Forms Printable Printable Forms Free Online, Personal income tax rates for tax year beginning january 1, 2025. Arkansas Employee Tax Withholding Form 2025, Personal income tax rates for tax year beginning january 1, 2025.

Arkansas State Tax Forms Printable Printable Forms Free Online, Personal income tax rates for tax year beginning january 1, 2025.

Still need to prepare and file an ar return for a previous tax year? Find the arkansas tax forms below.

Arkansas 2025 Tax Booklet Rey Lenore, A comprehensive suite of free income tax calculators for arkansas, each tailored to a specific tax year.

Tax Brackets 2025 Single Cloe Annaliese, The tax tables below include the tax rates, thresholds and.

Arkansas State Tax Refund Schedule 2025 Avivah Livvie, Updated for 2025 with income tax and social security deductables.

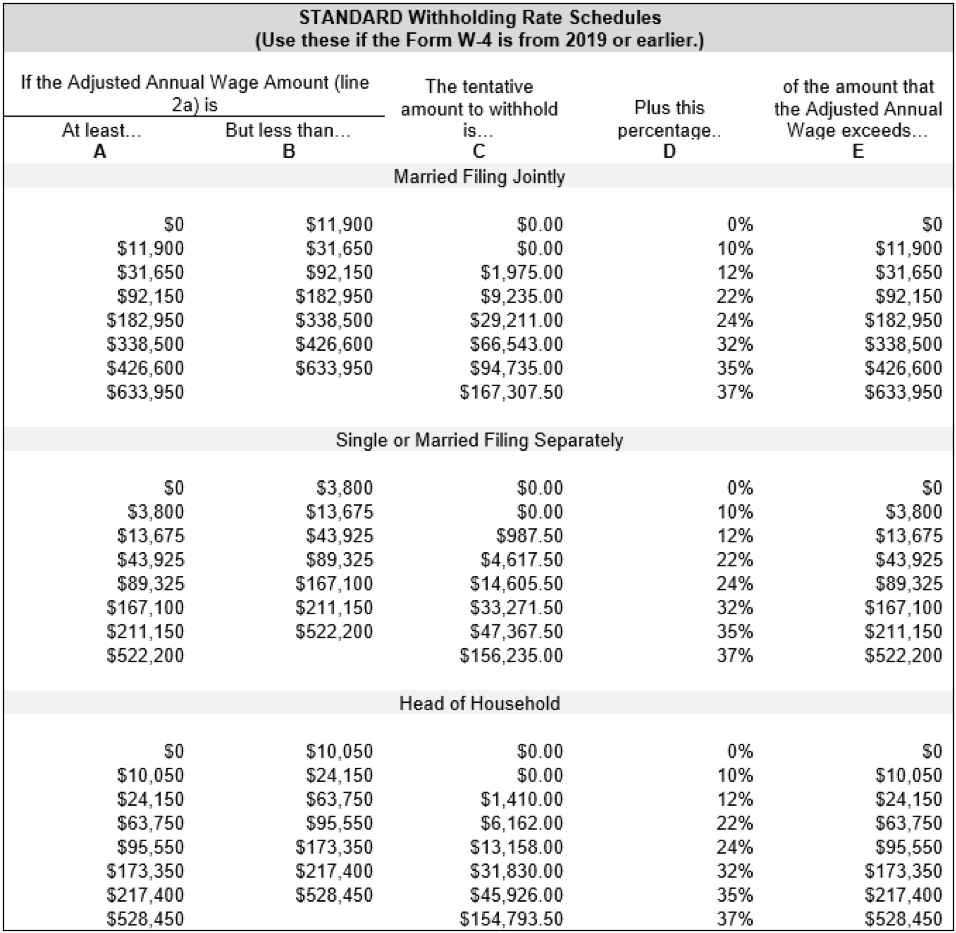

Tax Withholding Tables 2025 Angele Lauree, The arkansas department of finance and administration’s taxpayer access point (atap) service is an online platform designed to streamline the tax filing process for arkansas.

Arkansas Tax Schedule 2025 Chlo Melesa, The arkansas department of finance and administration’s taxpayer access point (atap) service is an online platform designed to streamline the tax filing process for arkansas.

Arkansas 2025 Tax Brackets Erina Jacklin, Ar1100ct corporation income tax return.

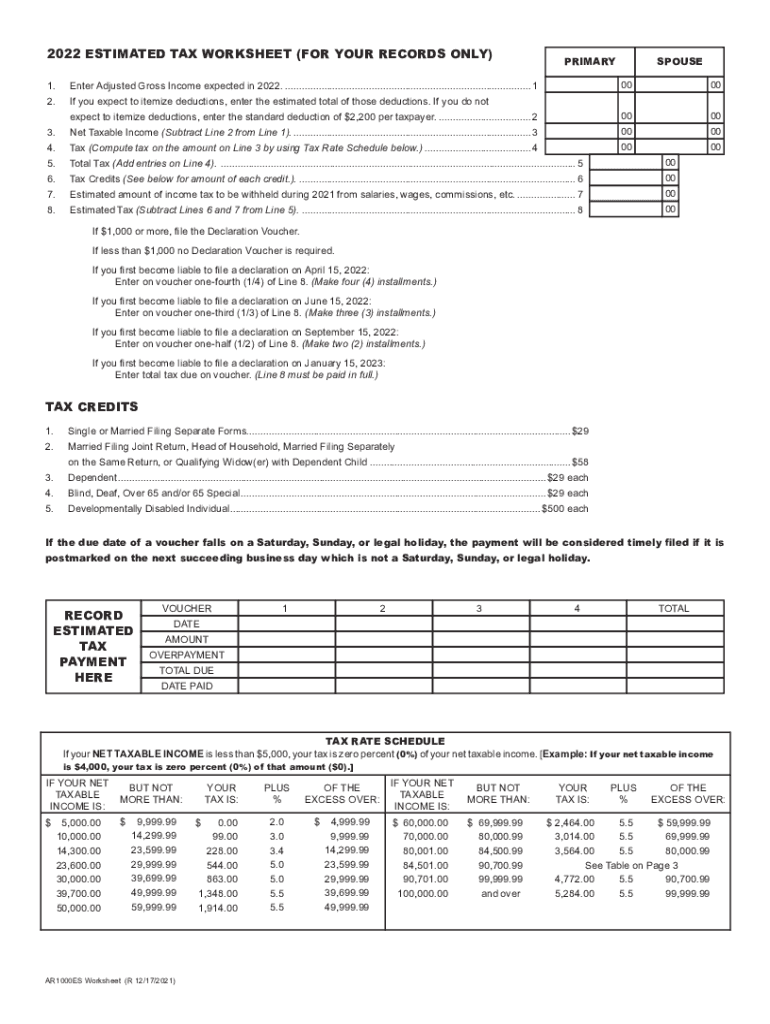

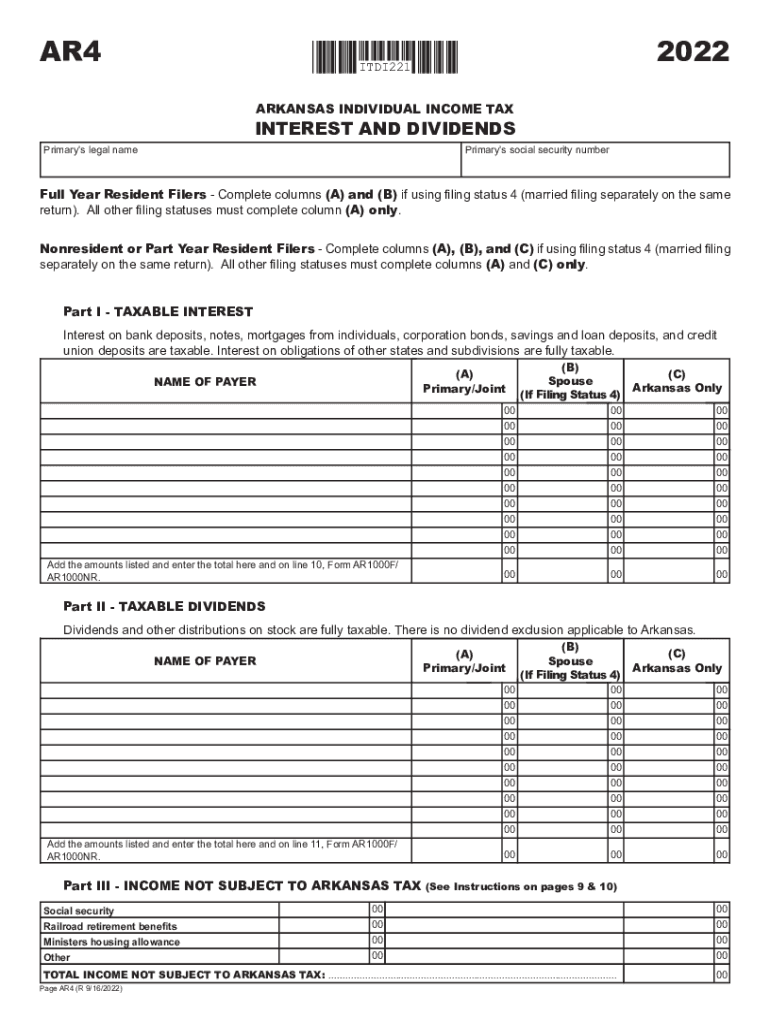

Ar4 20222025 Form Fill Out and Sign Printable PDF Template, Arkansas lowers personal income and corporate tax rates starting in 2025.

Arkansas Income Tax Schedule 2025. The arkansas department of finance and administration (dfa) announced that it has released updated state income tax withholding tables and a computer formula. Updated for 2025 with income tax and social security deductables.

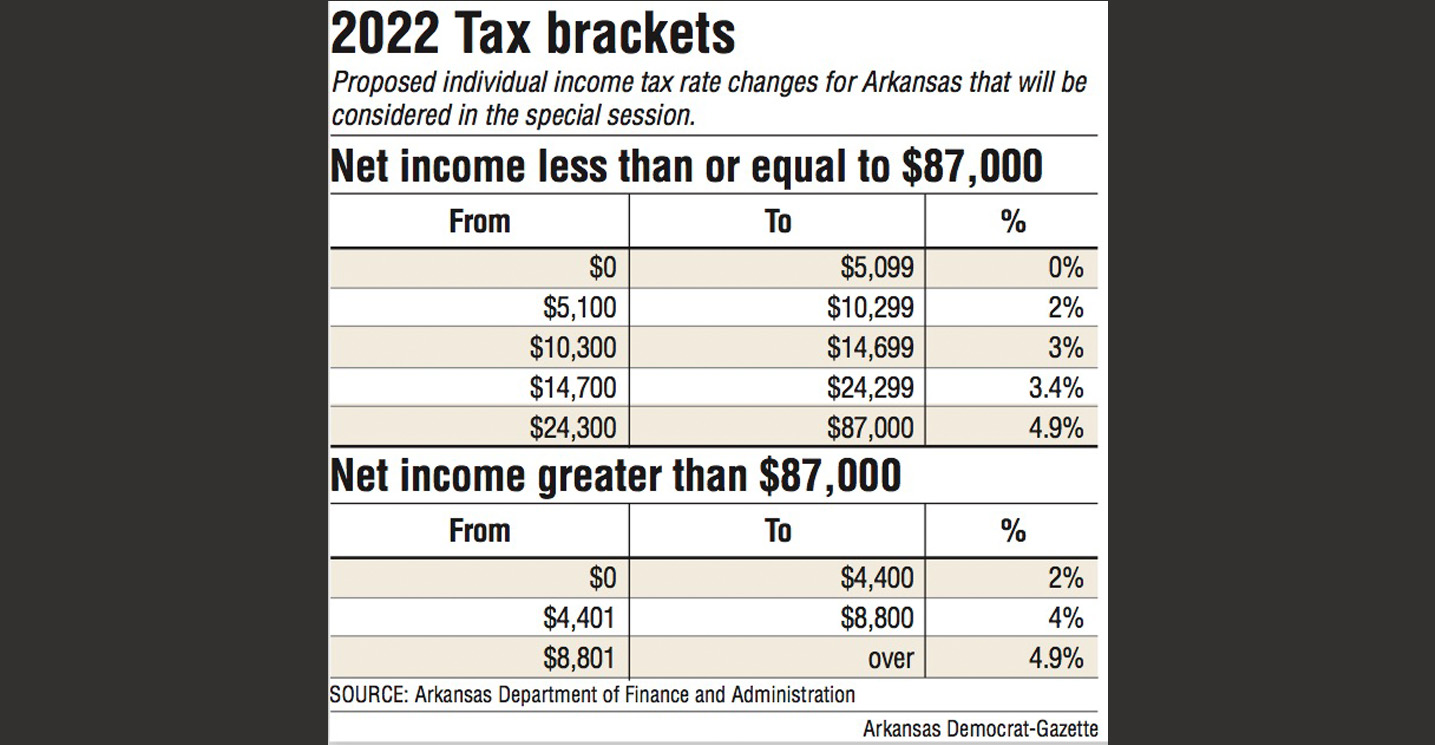

Tax Calendar 2025 2025 Calendar Printable vrogue.co, Arkansas' 2025 income tax ranges from 2% to 4.9%.